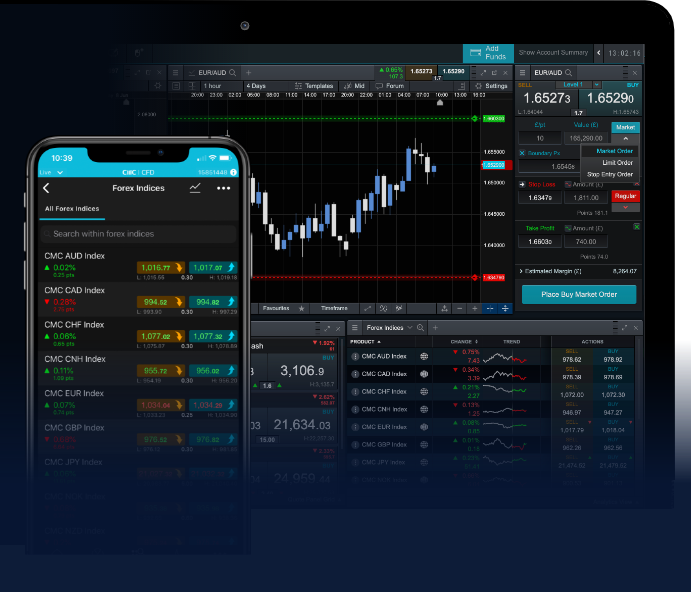

Robot trading in the Forex market has emerged as a game-changer for traders worldwide. With the increasing complexity of financial markets, robot trading forex FX Trading Broker has paved the way for the implementation of automated trading solutions. These robust systems are designed to execute trades based on predefined algorithms, analyzing market signals far more quickly than any human could manage. This article delves into the intricacies of robot trading, examining its advantages and challenges, while also shedding light on the technology that drives it.

Understanding Robot Trading

Robot trading, also known as algorithmic trading or automated trading, utilizes computer programs to automate trading decisions. These systems use complex algorithms to analyze market data and execute trades based on the analysis. Typically, robot trading is employed in high-frequency trading scenarios, where speed and accuracy are crucial.

How Does it Work?

A trading robot operates by interpreting multiple market indicators in real-time. It uses technical indicators such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands to determine optimal entry and exit points for trades. Once the parameters are set, the robot executes trades automatically without human intervention. The advantages lie in the ability to manage and execute several trades simultaneously, which significantly enhances trading opportunities.

Benefits of Robot Trading

The integration of robot trading in forex markets offers a myriad of benefits:

- Speed and Efficiency: Automated systems can process vast amounts of data and execute trades in milliseconds, far beyond human capability.

- Reduced Emotional Trading: Robots eliminate the emotional factors that can cloud judgment and lead to poor trading decisions.

- Backtesting and Optimization: Traders can test their strategies against historical data to ensure their effectiveness before live deployment.

- 24/7 Market Monitoring: Robots can monitor the forex market continuously, ensuring that no opportunity is missed regardless of time zones.

Challenges of Robot Trading

While there are numerous advantages to using trading robots, there are also some challenges that traders should consider:

- Market Volatility: Rapid market shifts can render algorithms ineffective, leading to significant losses if not programmed to adapt.

- Technical Issues: Software malfunctions or connectivity problems can hinder performance and affect trading outcomes.

- Over-Optimization: Designing a strategy that performs well on historical data can result in overfitting, which may not be effective in real trading conditions.

Essential Technologies Behind Robot Trading

The technology that powers robot trading includes various programming languages and trading platforms. Popular languages such as Python, C++, and Java are widely used in developing trading algorithms. Platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) offer functionalities to easily code, backtest, and deploy trading strategies. Furthermore, the integration of artificial intelligence and machine learning is becoming increasingly common, allowing for real-time strategy adjustments based on prevailing market trends.

Popular Trading Robots

Numerous trading robots have gained popularity among forex traders. Each comes with unique strategies catering to different trading styles:

- Forex Fury: A well-known robot that focuses on short-term strategies, designed for high-frequency trading.

- GPS Forex Robot: This trading robot utilizes a unique algorithm that supports profitable trading in any market condition.

- FXStabilizer: This robot combines trend-following and counter-trend strategies, minimizing risks while aiming for consistent profit.

The Future of Robot Trading

As technology evolves, the capabilities of trading robots will continue to expand. The integration of artificial intelligence and machine learning will lead to more sophisticated trading strategies capable of adapting to ever-changing market dynamics. The increasing acceptance of algorithmic trading by institutional investors is also likely to shape the future landscape of the forex market.

Conclusion

Robot trading is undeniably reshaping the forex trading landscape. While it offers various advantages such as speed, efficiency, and emotional neutrality, traders must also navigate the challenges that accompany automated systems. By staying informed about technological advancements and continuously optimizing their strategies, traders can leverage the full potential of robot trading and enhance their trading performance in the dynamic forex market.