The dividend payout ratio is important because it provides investors with insight into a company’s ability to sustain its current level of dividends in relation to its earnings. Companies with a strong track record of consistent and rising dividends may use a high payout ratio to indicate their robust financial health, appealing to investors seeking regular income through dividends. On the contrary, a low payout ratio may imply that a company is retaining more earnings to fuel expansion, research, and development or pay down debt.

Tesla hits US$1 trillion market value as Musk-backed Trump win fans optimism

More mature companies will also probably be less interested in reinvesting money into growing the business and more focused on distributing a consistent and generous dividend to shareholders. A long-time popular stock for dividend investors, it slashed its dividends on February 4, 2022, in order to reinvest more cash into the business following its spin-off of WarnerMedia. When examining a company’s long-term trends and dividend sustainability, the dividend payout ratio is often considered a better indicator than the dividend yield.

What is a Good Dividend Payout Ratio?

Calculating the retention ratio is simple, by subtracting the dividend payout ratio from the number one. The two ratios are essentially two sides of the same coin, providing different perspectives for analysis. In the second part of our modeling exercise, we’ll project the company’s retained earnings using the 25% payout ratio assumption.

Would you prefer to work with a financial professional remotely or in-person?

Remember that we can earn on the stock market by receiving dividends and by trading stocks at different prices. Simply put, the dividend payout ratio is the percentage of a company’s earnings that tax office and are issued to compensate shareholders in the form of dividends. No single number defines an ideal payout ratio because adequacy largely depends on the sector in which a given company operates.

- Analysts scrutinize this ratio to determine if a company has a sustainable dividend policy.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- By contrast, a company with adequate liquid resources may distribute a larger portion of its profits to shareholders.

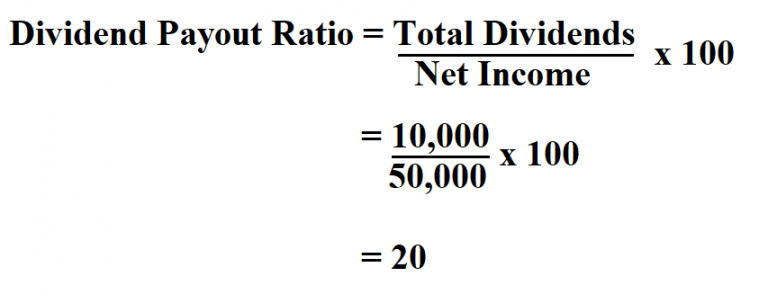

The payout ratio is a financial metric that measures the proportion of earnings a company pays its shareholders in the form of dividends, expressed as a percentage of the company’s total earnings. The dividend payout ratio can be calculated as the yearly dividend per share divided by the earnings per share (EPS), or equivalently, or divided by net income dividend payout ratio on a per share basis. In this case, the formula used is dividends per share divided by earnings per share (EPS). EPS represents net income minus preferred stock dividends divided by the average number of outstanding shares over a given time period. One other variation preferred by some analysts uses the diluted net income per share that additionally factors in options on the company’s stock. The augmented payout ratio incorporates share buybacks into the metric, which is calculated by dividing the sum of dividends and buybacks by net income for the same period.

How often does InvenTrust Properties pay dividends?

While this might seem like a good thing, it could also mean the company isn’t saving enough for its future or might be facing some financial challenges. One of the reasons for this steadiness and growth is the company payout ratio. Companies with high growth and no dividend program tend to attract growth investors that actually prefer the company to continue re-investing at the expense of not receiving a steady source of income via dividends. The Dividend Payout Ratio is the proportion of a company’s net income that is paid out as dividends as a form of compensation for common and preferred shareholders.

Companies may adjust their dividend policies based on various factors such as earnings growth, cash flow requirements, investment opportunities, and changes in their financial position. It is important for investors to monitor any changes in the ratio and understand the reasons behind them. The dividend payout ratio can affect shareholder value, as it determines the distribution of earnings between shareholders and retained earnings. A well-balanced ratio can enhance shareholder value by maintaining an optimal balance between dividends and reinvestment. Companies in their early growth stages tend to reinvest a significant portion of earnings back into the business to fuel expansion. As a result, their dividend payout ratios are generally lower compared to well-established companies.

This tactic is often undertaken when attempting to inflate stock prices in the short term. New companies still in their growth phase often reinvest all or most of their earnings back into their business, whereas more mature companies often pay out a larger percentage of their earnings in the form of dividends. In fact, some high-growth companies may pay no dividends because they prefer to reinvest their profits in the business for future growth.